You are about to embark on one of the most amazing and rewarding experiences that can ever come from spending money: buying a home. If you are buying a home in 2019, you should know that the entire process is not quick, but when all is said and done, there are few things more exhilarating than buying a house. This guide will help equip you with what you need to buy a house this year.

Check Your Credit Score

Before applying for a loan and certainly before ever making an offer on a house, you should know your credit score. Why is your credit score important? Well, it’s not only the difference between getting a low-interest rate on a home loan versus a high one, but it will also directly impact how much a bank or lender will actually loan you. There are several websites you can use to check your credit score, here are a few to consider: TransUnion, Equifax, Experian.

You can check your own score as much as once a day without affecting your credit, also known as a soft inquiry. Hard inquiries are when financial institutions check your credit score, typically when you’re applying for a loan or credit card. Hard inquiries lower your credit score a few points, so try to keep hard inquiries to a minimum.

Improve Your Credit Score

Maybe you just checked your credit score and realized it’s not as high as you had expected. Don’t worry, there are a few things you can do now that will help raise your credit score so you can capitalize on a great interest rate.

Though you can easily implement steps to help your credit score, fixing or raising a credit score doesn’t happen overnight. It’s imperative to start now so when you go to apply for a home loan your credit score will (hopefully) be where you want it. Here are three tips to help improve your credit score, and recommended by John Heath, Directing Attorney at Lexington Law:

- Obtain and Closely Review Your Free Credit Report: In order to improve your credit score, you first need to know what information is on your credit report. The Fair Credit Reporting Act (FCRA) gives you the option to obtain a free credit report from each of the three nationwide consumer reporting companies once every twelve months. Your credit report contains information including your current and past residences, how you pay your bills, bankruptcies, foreclosures and more. Obtaining and understanding the information on your credit report will help you know what you may need to address in order to improve your credit score.

- Use a Credit Report Repair Company to Dispute Errors: Your credit history is 35 percent of your FICO score, and according to a 2013 study by the Federal Trade Commission (FTC), more than 40 million Americans have something that is incorrect on their credit report. While a late payment or derogatory mark from a creditor may seem harmless, it can have long-standing consequences, in some instances staying on your report for seven years. If you have errors on your credit report, consider working with a credit repair company, who can navigate the complexities of credit repair, contact the credit bureaus on your behalf and help remove any errors as quickly as possible.

- Spread Credit Card Debt Across Multiple Cards: If any of your credit cards are close to the maximum utilization point, it will be a red flag to lenders, who see this as an indication that you could be having financial issues. If you have multiple cards, spreading the balance out between them could make sense. For example, instead of having one card that is 90 percent maxed out while two other cards have a zero balance, having a 30 percent balance on each card can help your credit score. Reducing overall debt is always the best option, but spreading out your balance can have a positive impact.

“Improving one’s credit score may take time, but it can be done. Bad credit is not irrevocable,”said Heath. “Developing good habits and repairing your credit report will help increase your credit score so you’re able to secure a home loan or a great interest rate with confidence.”

Know What You Can Afford

The best way to determine how much house you can afford is to simply use an Affordability calculator. Though calculators such as these do not necessarily account for all of your monthly expenditures, they certainly are a great tool for understanding your larger financial situation.

After you figure out what you can comfortably afford, you can then start online window shopping for houses and really begin to narrow down what you want in a house versus what you can afford. Are you looking at specific neighborhoods? How many bedrooms do you want? Do you need a large yard, big deck, swimming pool, man cave, she shed, etc?

Understanding what you can afford in the area you want to buy will help keep you grounded and focused on what you actually want in a house versus what might be nice to have.

Read this guide for more information about all of the important factors to consider when calculating the amount you can afford when purchasing a home – How Much House Can I Afford.

Save Up For a Down Payment

Unless you want to pay Private Mortgage Insurance (PMI), you really want to save up for a sizable down payment. PMI is an added insurance charged by mortgage lenders in order to protect themselves in case you default on your loan payments. The biggest problem with PMIs for homeowners is that they usually cost you hundreds of dollars each month. Money that is not going against the principal of your mortgage.

How much should you save for a house? Twenty percent down is typical with most mortgage lenders in order to avoid paying for PMI. However, there are other types of home loans, such as a VA loan if you have served in the military and qualify, that may allow you to put down less than twenty percent while avoiding PMIs altogether.

As an added benefit to having a sizable down payment, you may also receive a lower interest rate that will save you tens of thousands of dollars in interest over time. So start saving now!

Build Up Your Savings

Build Up Your Savings

Lenders like to see a healthy savings account and other investments or assets (i.e. 401k, CDs, after-tax investments) that you can tap into during hard times. What they really want to see is that you are not living paycheck to paycheck. A healthy savings account and other investments are a good idea in general as it will help you establish your future financial independence, but it is also a necessary item on your checklist of what you need to buy a house in 2019.

Have a Healthy Debt-to-Income Ratio (DTI)

Another key component banks and other lenders consider when issuing loans, and at what interest rate, is your debt-to-income ratio. The debt-to-income ratio is a lender’s way of comparing your monthly housing expenses and other debts with how much you earn.

So what is a healthy debt-to-income ratio when applying for a home loan? The short answer is the lower the better, but definitely, no more than 43% or you may not even qualify for a loan at all. There are two DTIs to consider as well.

The Front-End DTI: This DTI typically includes housing-related expenses such as mortgage payments and insurance. You want to shoot for a front-end DTI of 28%.

The Back-End DTI: This DTI includes all other debts you may have, such as credit cards or car loans. You want a back-end DTI of 36% or less. A simple way to improve this DTI is to pay down your debts to creditors.

How do you calculate your DTI ratio? You can use this equation for both front-end and back-end DTIs:

DTI = total debt / gross income

Budget for Extra Costs

There are a lot of little costs that go into buying a house that are overlooked by new home buyers all the time. Though there are some things, such as sales tax and home insurance, that can be wrapped into a home loan and monthly mortgage, there are several little things that cannot be included into the home-buying package and need to be paid for out of pocket.

Though these items can range in price depending on the area, size and cost of the house your buying, here is a list of extra costs you should consider (not all inclusive):

- Home Appraisal Fee

- Home Inspection Fee

- Geological study

- Closing costs*

- Property taxes**

- Home insurance**

- Utility hookup/start fees

- HOA fees

- Home remodeling/updating

- Existing propane gas

*Closing costs can sometimes be wrapped into the home loan, depending on the agreement with your lender.**Property taxes and home insurance can be paid separately or your lender could include it into your monthly mortgage payment.

Don’t Close Old Credit Card Accounts Or Apply for New Ones

Closing a credit card account will not raise your credit score. In fact, in some cases, it may actually lower it. Instead, try to pay down the balance as much as you can, while continuing to make your monthly payments on time. If you have an old credit card you never use anymore, just ignore it, or at least don’t close it until after you have purchased your new home.

Opening new credit cards before buying a home is also not a good idea. You don’t want creditors checking your credit or opening new cards under your name, as you may lose some points on your credit score.

The absolute worst thing you can do is max out one of your credit cards, even if the limit on the card is low. If you do, your credit score may plummet. Try tackling your credit cards with the highest interest rate first, then as one gets paid off, focus on the next card until you’re free and clear.

A Solid Employment History

If you haven’t gotten the picture yet, lenders like consistency, including your employment history. Lenders like to see a borrower with the same employer for about two years.

What if you have a job with an irregular or inconsistent pay schedule? People with jobs such as contract positions, who are self-employed, or have irregular work schedules can still qualify for a home loan. A mortgage known as a ‘Bank Statement’ mortgage is becoming rapidly popular with lenders as more self-employed or what has been referred to as the ‘gig economy’ has taken off.

Know the Difference Between a Fixed Rate and an Adjustable Rate Mortgage

The difference between these two types of mortgage rates really lies within their names. A fixed rate loan is exactly that, an interest rate that will never change the moment it’s locked in. You will pay the same amount the very first month you pay your home loan and will continue to pay that same exact amount over the course of thirty years (or however long the loan term is).

An adjustable-rate mortgage (ARM) is typically a mortgage that starts out as a lower rate than fixed interest rates but then is adjusted each year typically resulting in a rate higher than a fixed rate. A 5-1 ARM is a popular mortgage offered by lenders, which is a hybrid between fixed and adjustable rate mortgages. Your mortgage would start out at a lower fixed rate for the first five years, then after that time period has elapsed, the rate would then be adjusted on an annual basis for the remainder of the loan term.

Follow Interest Rates

It is important to know what interests rates are doing. The big question is are they on the rise or are they falling?

When the economy is good the Federal Reserve typically raises the interest rate in an effort to slow down economic growth in order to control inflation and rising costs. When the economy is in the dumps the Fed does the exact opposite. They lower the interest rate in order to entice more people to make larger purchases that require loans (i.e. land, cars, and houses) to help stimulate the economy.

As new soon-to-be homeowners, it’s a good idea to know how the overall economy is doing, and more importantly, how it’s impacting the interest rates you’ll soon be applying for. In 2018, after years of bottom of the barrel interest rates, the Fed raised interest rates three times and is projecting to raise it three more times in 2019.

Why are small hikes in interest rates so important to you? To put it into perspective, even a one percent increase in your interest rate on a home loan is the difference of paying or saving tens of thousands of dollars in interest payments on your home loan over time.

Know How Much Time it Takes to Buy a House

The home buying process from start to finish is time-consuming and very relative to individual circumstances and the housing market in your area. However, there are some general universal constants that you can expect, such as a cash offer on a house is usually much quicker than a traditional loan, and if there is a perfect house in a good neighborhood and at a great price, you better expect competition and added time for a seller to review offers.

Depending on the housing market in your area and possibly which season you’re buying in, it can take you a couple of weeks to find a home or more than a year. But after you find your home you can typically expect the entire process from making an offer on a house to walking in its front door, to be as little as a few weeks to a couple of months on average.

Find a Knowledgeable Real Estate Agent

There are several ways to find a knowledgeable real estate agent. Many people rely on recommendations from friends and family, while others look to online reviews. While both of these scenarios work really well and can land you a great real estate agent, the reason these agents rise above the others as the best of the best or the crème de la crème is because of their intentions.

A good real estate agent isn’t trying to get you into a house as quickly as possible so they can earn a commission. Instead, you want an agent that will act as your guide through the home buying process, while having your best interests in mind. A good agent will be able to tell you straight if they think a house is a good fit for you, or if you should keep looking. They should also be expert negotiators so that you get the best deal possible.

Find a Mortgage Lender

There are a few things to keep in mind when researching a mortgage lender. The first thing that comes to most people’s’ minds is what mortgage rate can they get. You may have to shop around to find the best rate because lower the rate the more money you save.

Secondly, how does that mortgage lender rate compared to other lenders? By looking at positive and negative online reviews you can usually establish a theme pretty quickly of the strengths and weaknesses of the lender, and what you can possibly expect for a level of service down the road.

Ask the lender what their average length of time is to close on a house after the offer has been accepted? A good lender versus a bad one can be the difference of moving into your new home two to four weeks earlier. You want to find out how streamlined their processes are.

Get Pre-approved

When being approved by a mortgage lender, you should be aware that there is a small but relevant difference between the typical fast preapproval for a home loan versus an underwritten pre-approval.

The fast pre-approval usually encompasses a credit report and a loan officer review and can be done in less than a couple of hours. This basic pre-approval allows you to quickly know how much you can afford and then make an offer on a house that may have just come on the market.

The underwritten pre-approval usually takes about twenty-four hours and includes a credit report, loan officer review, underwriter review, and a compliance/fraud review. Though this process takes longer, your offer on a house is actually stronger. Eventually, if you’re planning on buying a house, you will have to go through the underwritten pre-approval process anyway, so it’s better to jump on it from the start.

Research Neighborhoods or Areas You Want to Live

There are many variables to think about when researching your future residents. The key to beginning your research is to determine those variables most important to you. Are you looking for a good school district, a large house, convenience to commuter options, or a specific neighborhood that is extremely friendly and ranks high on Walk Score?

Your real estate agent will most likely tell you to figure out your list of the things you absolutely want in a house versus the extra features that you would like to have, but wouldn’t deter you from a house if it wasn’t there.

Your list will help your agent narrow down the number of houses they’ll show you, saving you time by only showing you houses you’d actually be interested in.

Shop For Your Home and Make an Offer

Now that you know where you want to live and you’re pre-approved, the fun begins. You get to look at houses! Once you find the house you know would be a great fit for you and your family, you’ll want to make an offer.

There are numerous variables to consider and hopefully, your knowledgeable real estate agent will help you through this process. Understanding the market conditions, how houses have been selling in the neighborhood and at what price (above or below asking), and knowing if there are other competing offers will help you assess and determine how you’d like to make an offer.

Negotiating an offer on a house can be emotionally taxing, so do your research and rely on your agent’s advice so you come to the table prepared.

Get a Home Inspection

Congratulations are in order! The sellers have accepted your offer. Now you want to get the home inspected to make sure there are no underlying issues that could cost you money down the road, such as a bad roof or foundation. Usually, a home inspection is a contingency built into the initial offer, and your real estate agent can help you set this up. However, it is recommended to hire an inspector that is certified by a national organization (such as ASHI or Inter-NACHI). Though you can waive this contingency if you’re trying to make your offer more competitive in a hot market. Just be aware that if you do waive a home inspection contingency, you may be taking on considerable risk.

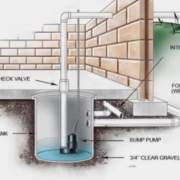

There are several types of home inspections, but in general, a typical home inspection involves a certified inspector that will go in, around, under, and top of your house looking for anything that could be of concern, such as structural or mechanical issues. The inspector would also look for safety issues related to the property. Though they will go into crawl spaces and attics as part of their inspection, they will not open walls. They will inspect the plumbing and electrical systems and should point out any defect in the property that could cost money down the road for the homeowner.

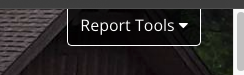

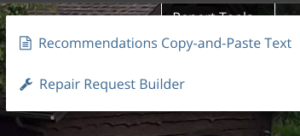

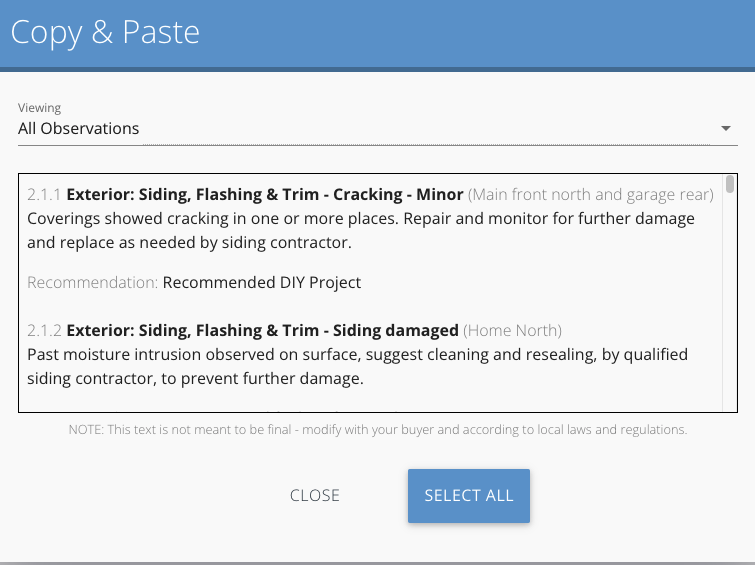

Then they will put their findings into a nice written report for you with pictures, which then basically becomes a miniature instruction manual for your house. No house is perfect, but the report will give you a great snapshot of the property at the time of the inspection. If there are fixes that need to be addressed, this report will certainly let you know.

You should also know that the sellers are not required to make any repairs to the property. However, you can request them through your real estate agent, which will let you know what repairs are reasonable or not.

Have the Home Appraised

Home appraisals are an important part of the process because oftentimes house prices can quickly skyrocket when the housing market is hot, and banks do not like to loan out more money than what a home is worth. A home appraiser will not only tell you what the home is actually worth for the area and for the current housing market, but this appraisal will also directly affect the size of loan the bank will give you.

If the home appraisal comes back and states that the house is worth $300,000, but you made an offer of $310,000, the bank will most likely only lend you $300k. You will then either be stuck with paying the additional $10k out of pocket, or you may try to renegotiate the price with the sellers to see if they would be willing to come down. Or you may lose the house altogether.

Also, the mortgage lender will usually set up the home appraisal so you can take this time to focus on other home-buying tasks that need to be finished up.

Close the Sale and Sign The Papers

Congratulations, you’re a homeowner! Your real estate agent should help you map out the last details, such as when and where you should sign all the papers to take ownership of the house and, of course, the handing over of the keys. Welcome to your new home.

Written by guest author Jeff Anttila | December 4, 2018

As a homeowner, it’s essential to ensure your family and your property’s safety. You don’t want any unauthorized person breaking in your front door, which is why changing the locks in your new home is necessary. Do the task before moving in, so you’ll be able to lay in bed the first few nights in your new home with peace of mind. Additionally, getting your locks changed before the relocation will prevent your belongings from being exposed while you are switching over your locks.

As a homeowner, it’s essential to ensure your family and your property’s safety. You don’t want any unauthorized person breaking in your front door, which is why changing the locks in your new home is necessary. Do the task before moving in, so you’ll be able to lay in bed the first few nights in your new home with peace of mind. Additionally, getting your locks changed before the relocation will prevent your belongings from being exposed while you are switching over your locks.

Build Up Your Savings

Build Up Your Savings